The sale and purchase agreement must be drafted between 1st June to 31st May 2021. Paragraph 214A states that an undue cost or effort exemption is specified for some.

Exempt Private Company Timcole Accounting

To maintain a private limited company Sdn Bhd in Malaysia the following are the few routine compliance matters that one needs to be aware of.

. Local cars are sold. - The profits of a 501c3 nonprofit cannot inure to the benefit of a private individual. An exempt private company need not file its annual accounts with Registrar of Companies provided that the company files a certificate signed by a director the secretary and.

Promoter in relation to a prospectus issued by or in connection with a corporation. Annual Compliance for a Private Limited Company Sdn Bhd After incorporating a company in Malaysia it is important for all business owners to understand the legal requirements and compliance. Since 1st January 2015 until today Company A has not conducted any business activity.

On 7 October 2021 Suruhanjaya Syarikat Malaysia issued an e-postcard with the title. 414 Water St Suite 1607. 1 Company A was incorporated on 1st January 2015.

Practically this means that the entity cannot have stockholders and that the salaries it pays employees must be reasonable. Saham Syarikat dimiliki oleh individu orang perseorangan sahaja 2. Ecovis Malaysia and its related entities in Malaysia trading as Ecovis Malaysia is a member of the global network known as Ecovis International.

Company A was incorporated on 1st January 2016. Its shares cannot be held directly or indirectly or indirectly by any other company. The Companies Commission of Malaysia SSM or the Registrar have announced that the Companies Act 2016 CA 2016 and Company Regulations 2017 CR 2017 be implemented on a staggered basis with the first phase effective from 31 January 2017.

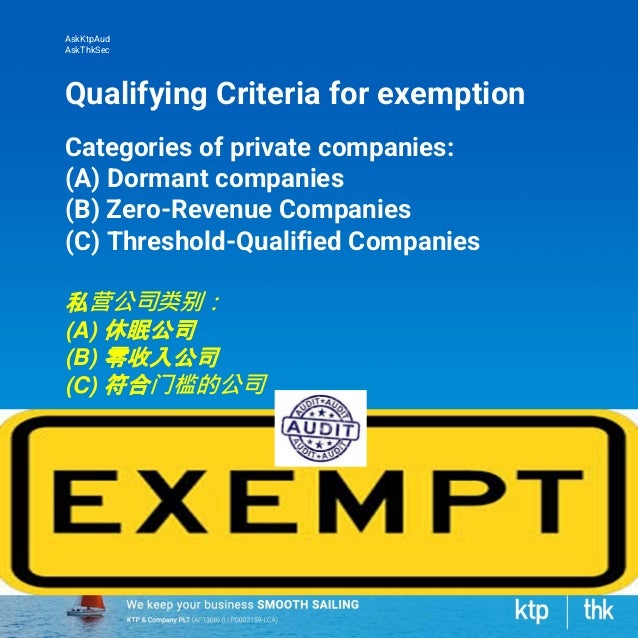

A threshold-qualified company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for an audit exemption if. If S has its own subsidiaries they are also subsidiaries of H. McCarter English LLP is a firm of over 400 lawyers with offices in Boston Hartford Stamford New York City Newark Philadelphia and Wilmington.

Notwithstanding this Section 2672 of the Companies Act 2016 empowers the Registrar of Companies to exempt any private company from auditing its financial statements. Clients come first at McCarter English. Kensington Corporate Services Malaysia Sdn.

If H itself is not a subsidiary of another company it is considered the ultimate holding company of the group. On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies. - A 501c3 cannot be organized.

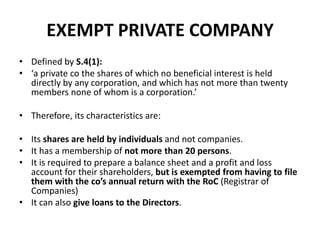

An Exempt Private Company can prepare its financial statements in its format so long as it is in accordance to the Singapore Financial Reporting Standards. Di samping itu terdapat dua 2 ciri utama Syarikat EPC iaitu -1. EXEMPT PRIVATE COMPANY 3 Dec 2020.

Have no more than 20 shareholders and. Being a company which has not ceased to be a private company under section 26 or 27. 132K Companies Involved in MA Buyer Seller or Target 29K MA Advisors Investment Banks and Law Firms 35K MA Contacts PE and MA Advisors.

Do You Know Your Roles Responsibilities In Respect of An Exempt Private Company EPCThe objective of the e-postcard is to provide a gentle reminder regarding the roles and responsibilities of directors to ensure that companies with EPC status comply with the. And b 1is not a subsidiary or associate of or jointly controlled by an entity which is. McCarter English LLP.

NA Tax exempt entities must comply with strict operational requirements. Assuming that the financial year end is at 31 December every year. In financial year ending 31 December.

Assuming that the financial year-end is on 31 December every year. Each member firm is an independent. What Is an Exempt Private Company in Malaysia 15042022 in by malzan.

Company A may apply for audit exemption. A Private Company must prepare its financial statements in XBRL format and upload these financial statements when filing for their Annual Returns. LODGER INFORMATION Name.

ACRA defines an Exempt Private Company EPC as a Singapore Company that meets the following 3 main characteristics. A private entity is a private company as defined in section 2 of the Companies Act 2016. Otherwise the Minister can also gazette the Company as an Exempt Private.

35K Private Equity Firms. Exempt Private Company EPC merujuk kepada Syarikat yang mempunyai sifat atau ciri-ciri yang sama seperti Syarikat Sdn Bhd. Company B was incorporated on 1st January 2016.

Dormant companies A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is. 2 Company B was incorporated on 1st January 2015. In continuous business for more than 160 years we are among the oldest and largest law firms in America.

But heres something to note. From 1st January 2016 until today Company A has not conducted any business activity. It has revenue includes revenue receivable during the year not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years.

Is a management services company in. Ecovis International is a Swiss association. Premier Private Car Service.

Ahli Syarikat tidak melebihi 20 ahli. Thus a company may have directly or indirectly several subsidiaries. Company A may apply for audit exemption.

It is an offence under section 591 of the Companies Act 2016 to make or authorize the making of a statement that a person knows is false or misleading and that person may be liable upon conviction to imprisonment for a term not exceeding ten years or to a fine not exceeding RM3million or to both. An exempt private company is a private limited company with not more than 20 members. Shareholders are all individuals of which none are corporations.

Administered by the Securities Commission or Bank Negara Malaysia. What is an Exempt Private Company EPC. Article 4 of the Law on.

To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private companies are eligible to elect for audit exemption. There is also a 10 discount that can be offered by property developers that are part of this campaign. Profit and loss account includes income and expenditure account revenue account or any other account showing the results of the business of a corporation for a period.

The main difference is the filing requirement.

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

Companies Limited By Share Guarantee Etc

How To Close A Sdn Bhd Company In Malaysia

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretarial

St Partners Plt Chartered Accountants Malaysia Ssm Effective Date For Companies Not In Kuala Lumpur And Selangor To Mandatory Submit Below Documents To Ssm Using The Malaysian Business Reporting System

8 Key Updates Of The Companies Act 2016 For Smes In Malaysia Foundingbird

Advantages And Disadvantages Of Private Limited Company Ebizfiling

8 Key Updates Of The Companies Act 2016 For Smes In Malaysia Foundingbird

Pin On Business Advisory Malaysia

Incorporating A Company In Malaysia Donovan Ho

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

8 Types Of Business Entities To Register In Malaysia Foundingbird

Malaysiakini Private Company Sarawak Family

National Oil Companies Leaning Into The Energy Transition Center For Strategic And International Studies

Starting An Exempt Private Company In Singapore Benefits And Process Singaporelegaladvice Com

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretarial